- In the world of investing, high-yield dividend stocks can offer appealing opportunities for income-focused investors.

- Five high-yield dividend stocks listed here are worth adding to your portfolio amid the current market turbulence.

- These companies operate in different industries, provide attractive yields, and have strong fundamentals to support their payouts.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

In the current environment of economic volatility and shifting interest rate expectations, high-yield dividend stocks remain a cornerstone for income-focused investors. These assets provide steady cash flow, often from resilient industries like energy infrastructure, real estate, insurance, and mining.

This article spotlights five standout high-yield dividend stocks: Energy Transfer Equity LP (NYSE:), Realty Income (NYSE:), CNA Financial (NYSE:), American Financial Group (NYSE:), and AngloGold Ashanti (NYSE:). Each offers yields above 5%, backed by robust fundamentals, making them compelling buys for long-term portfolios.

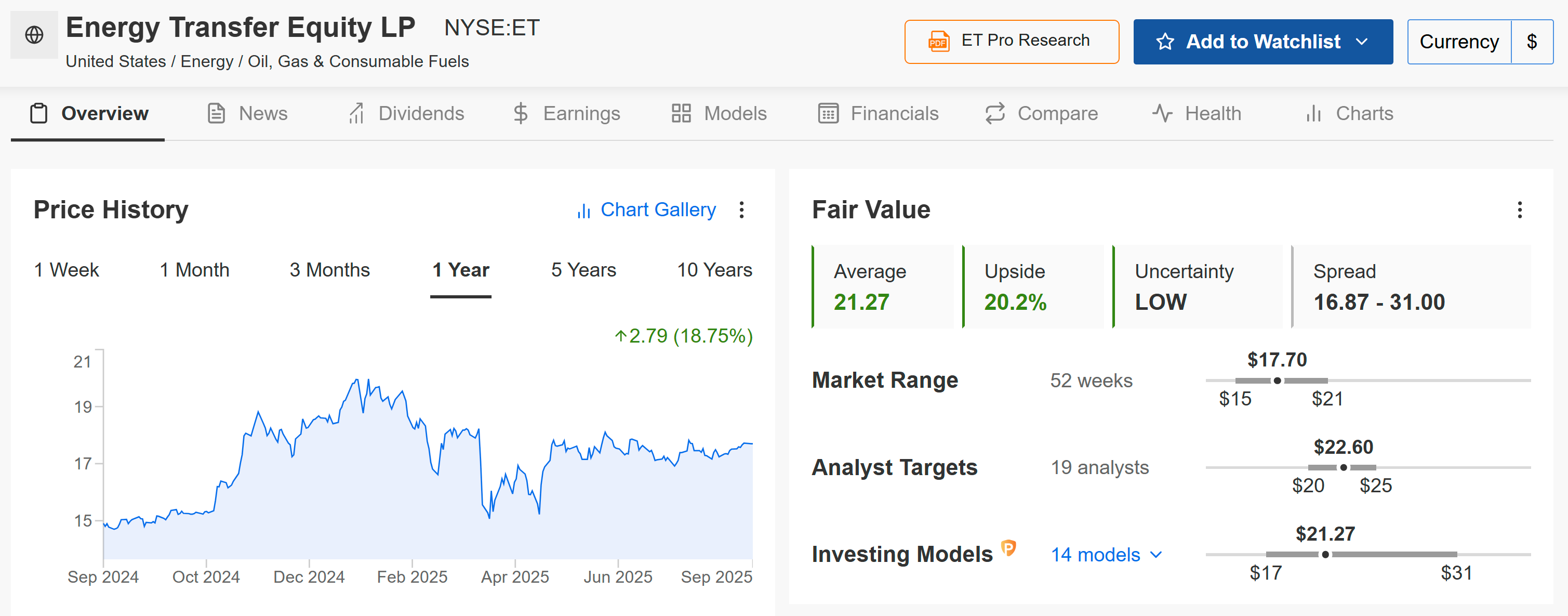

1. Energy Transfer LP – Midstream Energy Powerhouse

- Dividend Yield: 7.46%

- Annual Payout: $1.32 per share

Energy Transfer LP is a leading midstream energy company that operates one of the largest portfolios of energy assets in the US, including over 130,000 miles of pipelines for , and natural gas liquids (NGLs).

Source: InvestingPro

ET’s vast energy logistics network and consistent earnings underpin its robust payout. With a ‘Fair Value’ estimate of $21.27 (+20.2% upside) and a “Strong Buy” rating from analysts, it’s a classic income pick in a sector with long-term growth tailwinds.

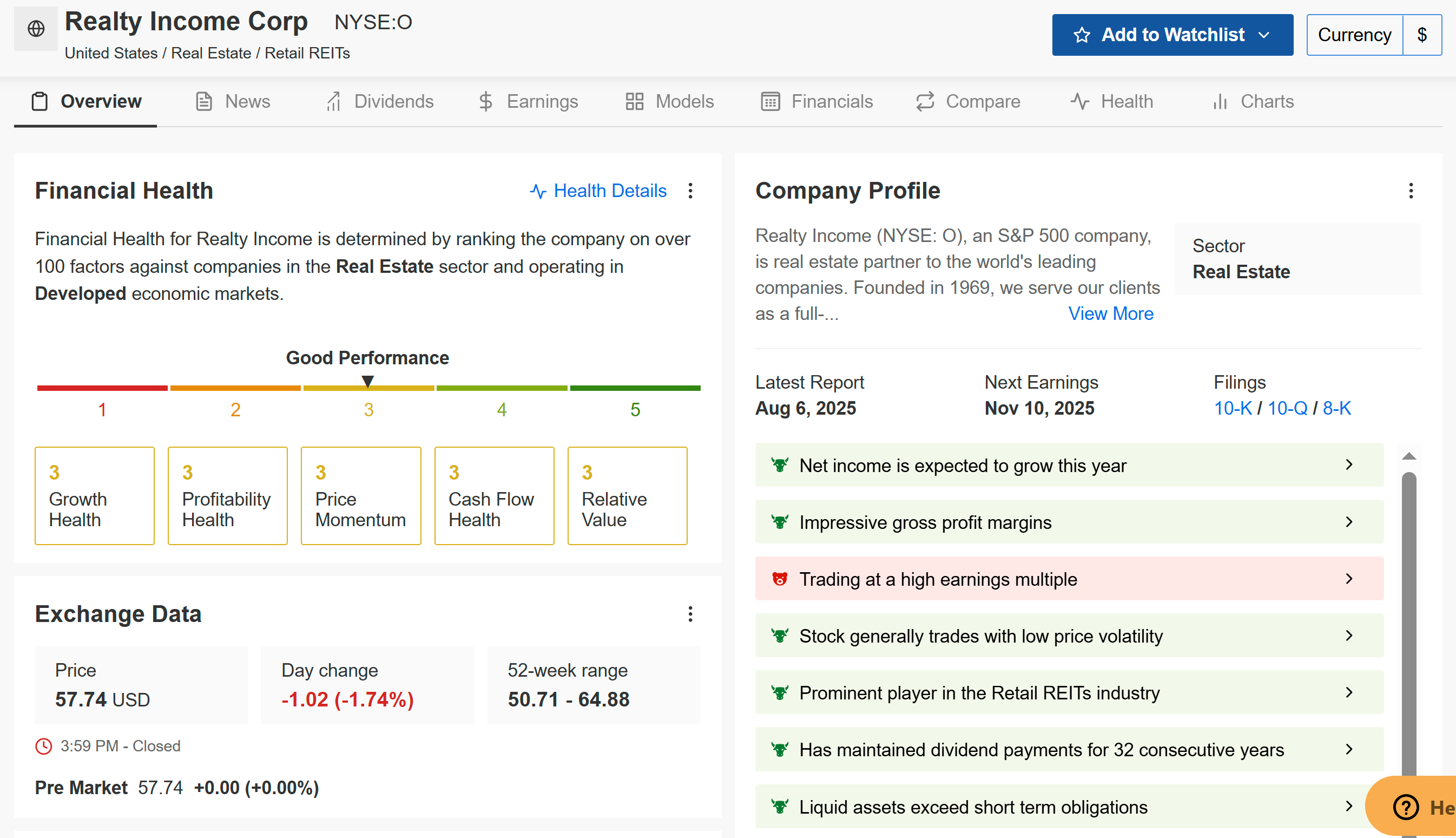

2. Realty Income – The Monthly Dividend Company

- Dividend Yield: 5.99%

- Annual Payout: $3.23 per share

Realty Income, an S&P 500 Dividend Aristocrat, owns over 15,000 single-tenant properties leased to recession-resistant retailers like Walmart (NYSE:), Dollar General (NYSE:), and 7-Eleven. Its net lease model shifts operating costs to tenants, ensuring predictable income.

Source: InvestingPro

Known as “The Monthly Dividend Company,” Realty Income’s 32-year track record of uninterrupted dividends is hard to match. Its diversified real estate portfolio and resilient operating model help offset higher rates, with a Fair Value of $55.93 (slightly below current price), but analyst targets suggest upside to $62.55.

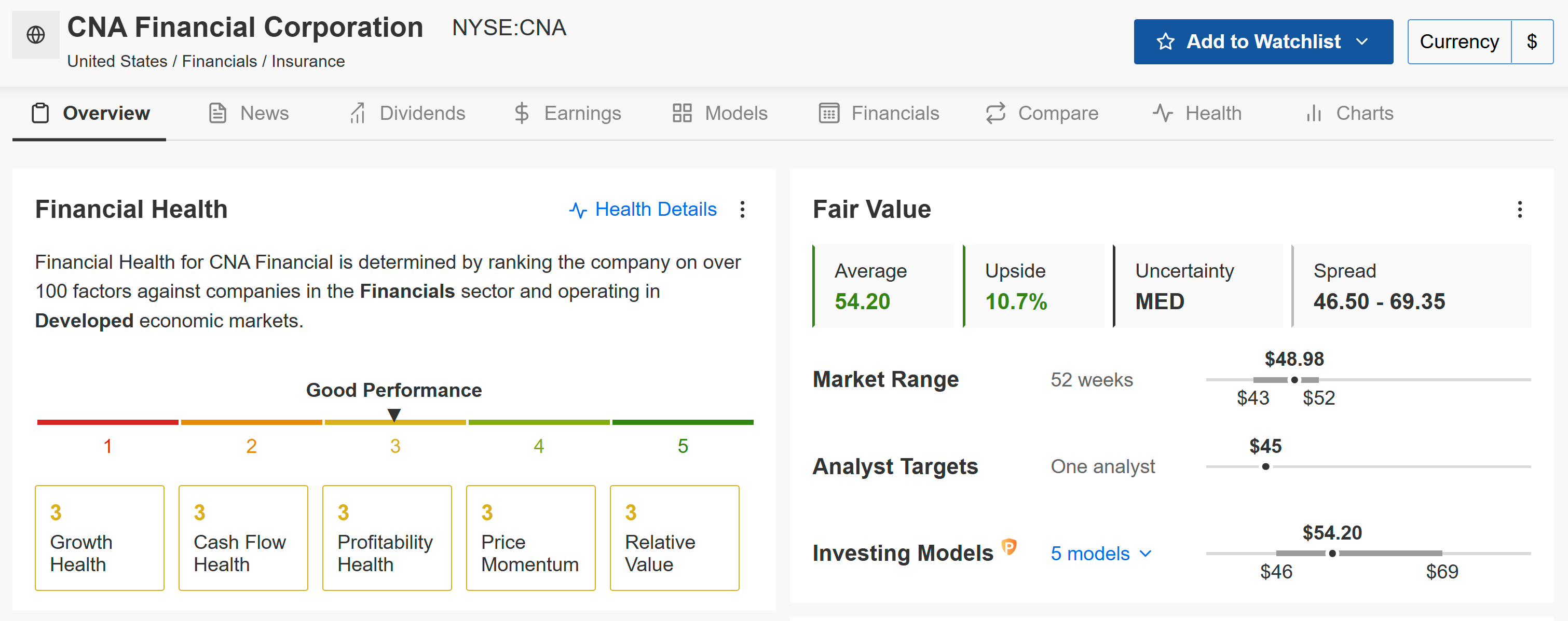

3. CNA Financial – Steady Insurance Anchor

- Dividend Yield: 7.84%

- Annual Payout: $3.84 per share

CNA Financial, a leading insurance company specializing in property and casualty insurance, benefits from disciplined underwriting and risk management practices. Its conservative investment portfolio and solid capital position allow it to maintain a steady dividend.

Source: InvestingPro

CNA stands out as a buy for its rock-solid dividends, increased for 10 consecutive years (3% CAGR), with a sustainable 54% payout ratio. Its Fair Value is $54.20 (+10.7% upside), while analyst targets are more conservative at $45.00, reflecting a cautious but consistent outlook.

4. American Financial Group – Specialty Insurance Leader

- Dividend Yield: 6.72%

- Annual Payout: $9.20 per share

American Financial Group focuses on specialty property and casualty insurance, demonstrating a strong ability to reward shareholders with consistent payouts and special dividends. The company’s disciplined underwriting and shrewd management of its investment portfolio consistently generate significant cash.

Source: InvestingPro

AFG’s specialty insurance focus and 40-year dividend streak make it a reliable income generator. The stock trades well below its Fair Value estimate ($175.80, +28.4% upside), and analysts see some near-term challenges but steady long-term potential.

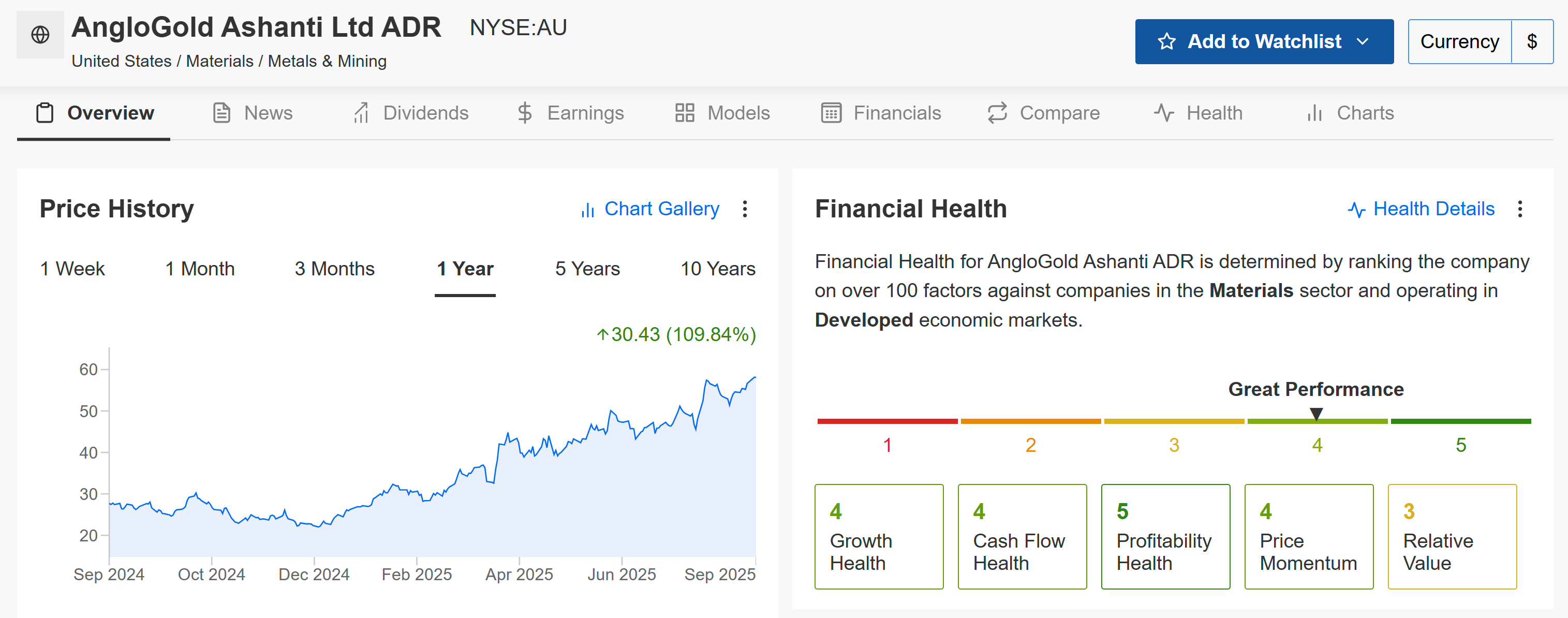

5. AngloGold Ashanti – Gold Mining Momentum Play

- Dividend Yield: 5.50%

- Annual Payout: $3.20 per share

AngloGold Ashanti operates gold mines across Africa, Australia, and the Americas, producing over three million ounces annually. With gold prices at record highs (~$3,500/oz), AU provides direct exposure to the classic safe-haven asset that investors flock to during times of inflation and economic uncertainty.

Source: InvestingPro

At 16.3x P/E (vs. industry 27x), it’s undervalued. Its price exceeds Fair Value ($56.17), but analyst targets reach as high as $70.00, riding earnings momentum and surging revenue growth.

Bottom Line

These high-yielders combine generous income with balance sheet discipline, sector diversity, and—crucially—analyst and Fair Value support. If you want income plus peace of mind when markets get choppy, this shortlist is built for you.

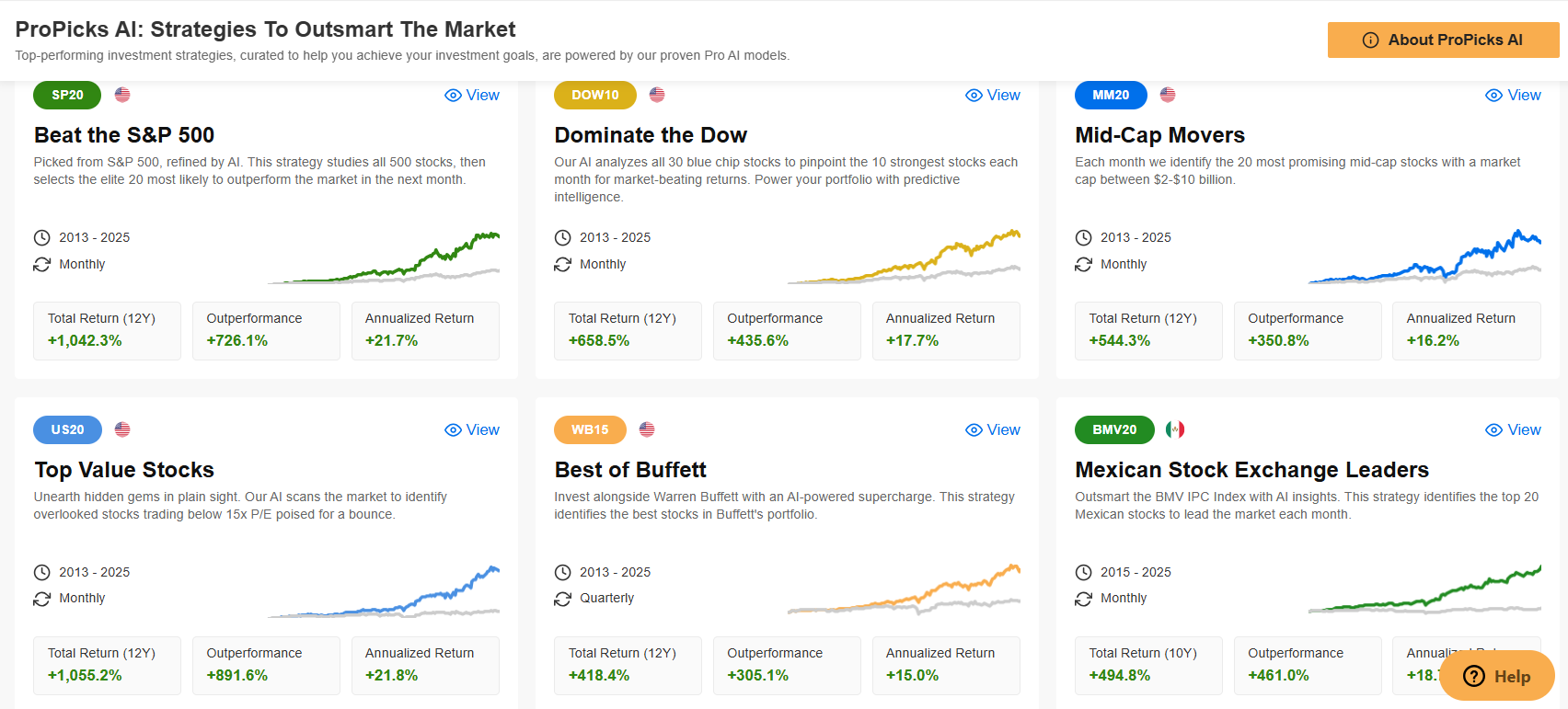

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.